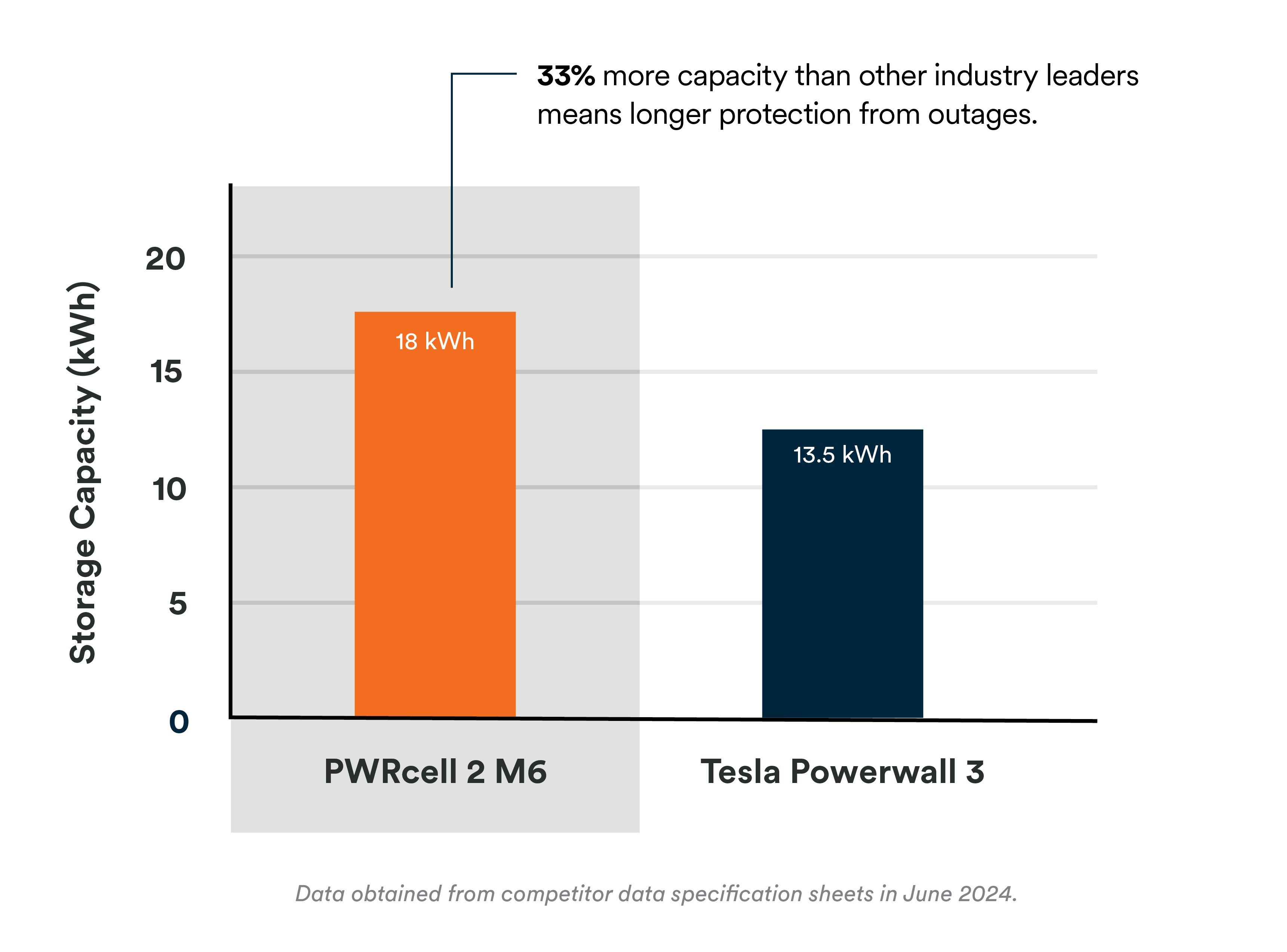

18 kWh capacity in a single cabinet

PWRcell 2 features one of the highest residential storage capacities available, providing not only additional savings opportunities compared to solar alone, but also up to 33% more backup capability than the current solar storage industry leader.